Summary

Many companies that recently registered in Germany receive fraudulent invoices claiming payment for a commercial register entry. These fake documents mimic official court charges but demand inflated fees (€300 to €1,200) and use urgent deadlines to pressure recipients. Red flags include foreign IBANs, short payment terms, and payment to private entities rather than the proper register court’s payment office. Awareness of this scam helps avoid unnecessary costs and legal complications. Checking the official court register payment details to verify the payment recipient is crucial!

Contents

Here’s how the scam works

New entries in the German commercial register 💬Handelsregister are published online, which makes it exponentially easier for scammers to scrape the data and send fraudulent letters by the thousands.

The fraud always follows the same formula: A few days after a new company is registered, the founder receives an invoice—supposedly issued by the local register court 💬Amtsgericht or a judicial treasury 💬Justizkasse. A commercial register entry is just one of the required steps to setting up an LLC in Germany, so the letter is expected. The founder is then directed to pay an often random amount between € 300 and € 1,200 for the company’s entry into the commercial register.

⚠️ The letter looks legitimate and copies layout, font and content perfectly. Only the account number and a few minor details give the scam away.

Since founders expect the invoice to arrive during this phase, many don’t question the legitimacy of it and make the payment without having second thoughts.

The payment period of these scam attempts is usually extra short, i.e. 3 working days. Plus, the scammers often mention a surcharge or reminder fee for late payments. Both are strong indicators of a scam and are meant to increase the pressure to make the payment as soon as possible—before the legitimate invoice arrives!

How to spot fraudulent invoices

The fake letter can hardly be distinguished from a legitimate one. Usually, some are three give-aways:

- Recipient’s account number (IBAN) is not German, i.e. does not start with DE—even if it is, always google it!

- Very short payment period (3 days) and threat of reminder fees.

- Payable amount is too high—it should contain two items and amount to €300 for LLCs. However, don’t trust the letter just because the scammer was smart enough to put the correct amount.

The following characteristics are used to make the fake seem similar to the official letter:

- File number

- Seal of the Bundesland

- Official reference number

- Document numbers

- Signature by a judge

- Descriptions in the subject line, which refer to publication or change in the industry or commercial register

- Layout of the text: Printing on official paper and in official typeface

Often, the fraudulent letter arrives before the official invoice from the district court in the hope that entrepreneurs will transfer the amount in anticipation of an official invoice without looking at it too closely.

Example

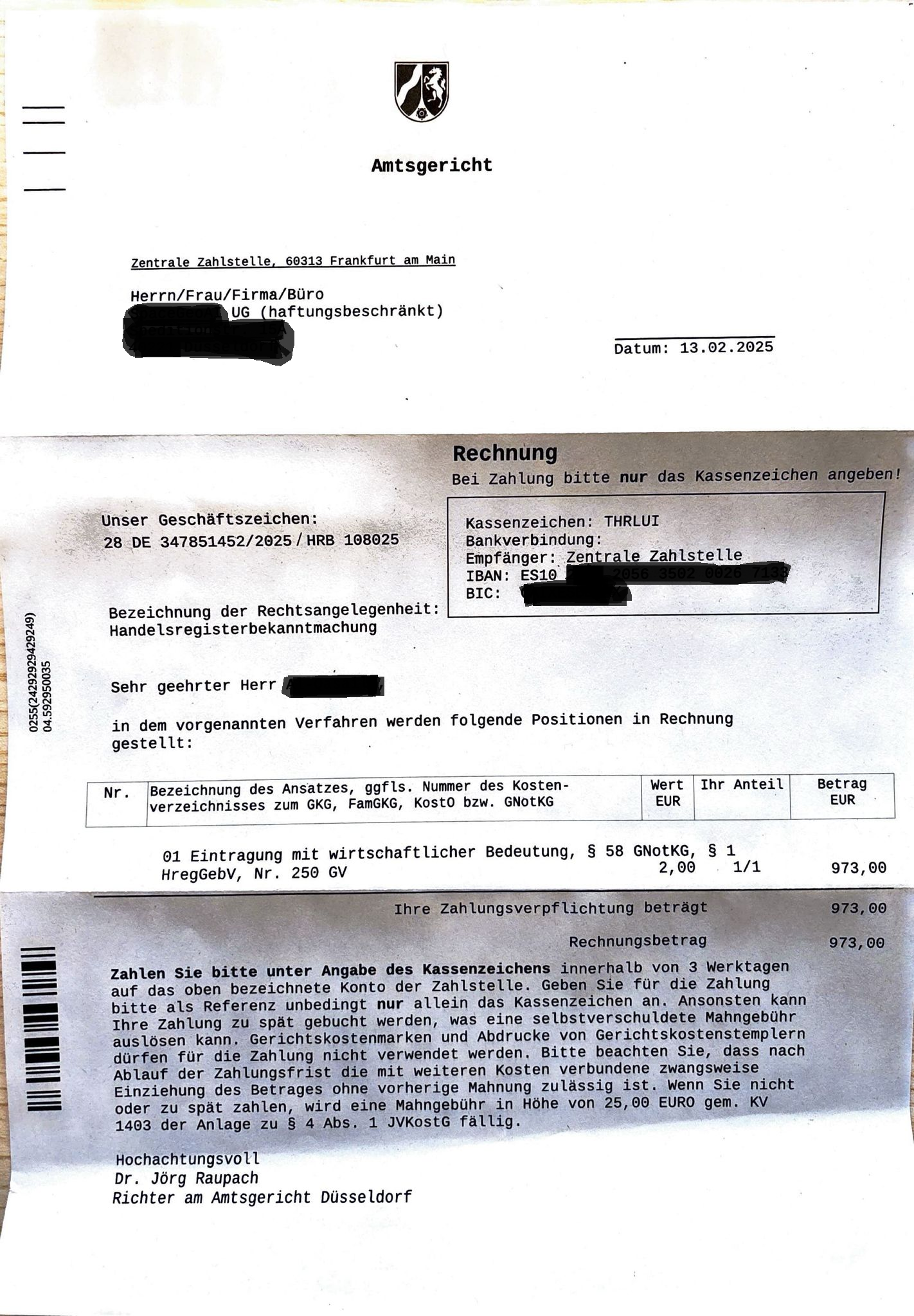

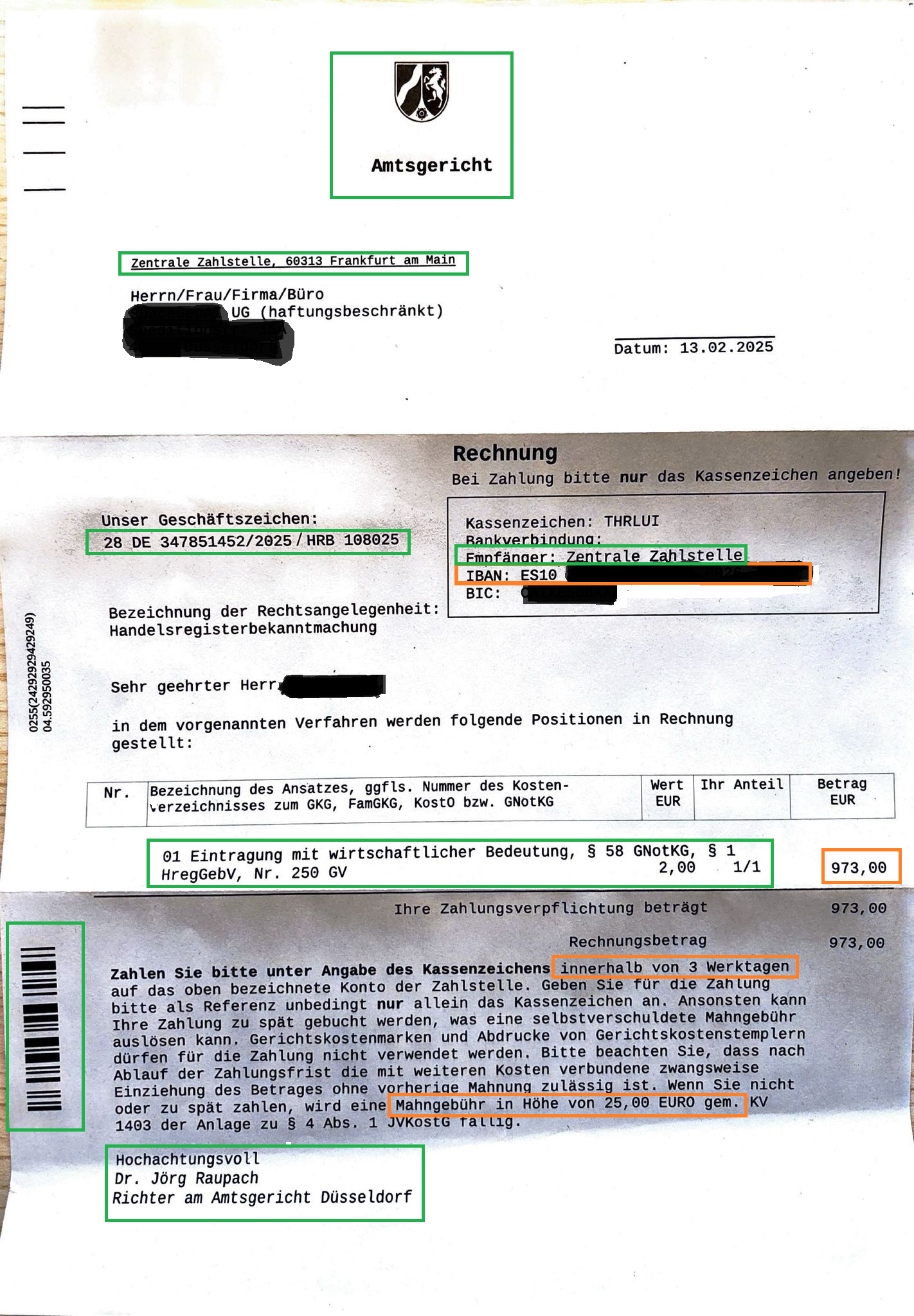

This is an example of a real scam attempt. Can you spot the give-aways? Find the solution below.

Here is the solution:

The green highlights are all the expected features of a court invoice that may mislead you into thinking it is perfectly legitimate.

The orange features reveal the scam:

- Spanish account number,

- wrong payable amount—more than triple of the correct one,

- very short payment period

- mentioning of additional fees.

Did you spot them all?

This one is visually smart but rather clumsy content-wise: it claims to be sent from the judicial treasury in Frankfurt (Hesse), yet the coat of arms and signature indicate that the sender is based in Düsseldorf (North Rhine-Westphalia)—two different federal states.

This oversight shows that these scammers are not particularly sophisticated and are unfamiliar with basic German geography and jurisdiction. Still, if you don’t know what to look for, you might easily overlook these details. Scammers love targeting international founders who are unfamiliar with German bureaucracy and therefore more vulnerable to mail fraud.

What should I do if I receive such a letter?

Do not pay! If in doubt, call the local district court or check their website for the correct account number. Verify the bank details to be on the safe side. If it indeed a scam attempt you don’t have to do anything. Consider filing a police report.

What should I do if I’ve already paid the money?

Start by contacting your bank immediately to try and stop or reverse the transfer. Then, file a police report. Contact a lawyer or the Association against Economic Crime 💬Schutzverband gegen Wirtschaftskriminalität.

📌 The sad truth is that in most cases, the money cannot be recovered.

Please don’t be too hard on yourself.

These criminals are well-organised and have refined their methods for more than a decade and deliberately target diligent business owners who simply want to pay official fees on time. This type of mistake can happen to anyone. Their schemes are sophisticated, and even experienced entrepreneurs have been caught out.

You weren’t careless—you were targeted by professionals!

Prevention and criminal prosecution are difficult

Although the German Federal Court of Justice classifies these fake invoices as fraud, recovering funds is extremely difficult. By the time victims notice the scam, the accounts used by the fraudsters have already been emptied and closed. Scammers work in groups and open numerous accounts using stolen identities, making it very hard to trace them across borders.

Example: You’ve transferred money to a fraudulent account hosted by a Polish bank. As soon as you realise what’s happened, you file a report with your local police station. They must then request legal assistance from the relevant Polish authorities—a process that can be slow and bureaucratic. Language barriers, administrative delays and the relatively low financial damage often mean the case is not treated as urgent. The scammers don’t leave any leads to follow but a stolen ID. Those are usually purchased on the dark web, which makes both sellers and buyers untraceable.

📌 Please report every scam attempt. Even if the chances of recovery are low, reports do help authorities identify patterns and prevent further victims. Plus, more reported cases also increase statistical visibility, which could justify additional funding and human resources in the future.

More scams: Fraudsters are inventive

Incidentally, scammers are not afraid to make repeated attempts at fraud with other fake invoices, e.g. imitating an invoice by the Patent and Trademark Office, tax office, transparency register, trade office. Whenever you expect an official invoice, be very mindful of the mail you receive.

Example of the EU trademark application

Conclusion

When you receive an invoice for the commercial register entry in Germany, do not pay until verification. Always verify the payment details first or contact the court office to confirm legitimacy. If you recognise signs of fraud—such as a foreign account number, unusual sender, high fees, or pressure to pay quickly—report it to the police and the economic crime protection association. Staying vigilant protects your business and prevents falling victim to this cost trap.